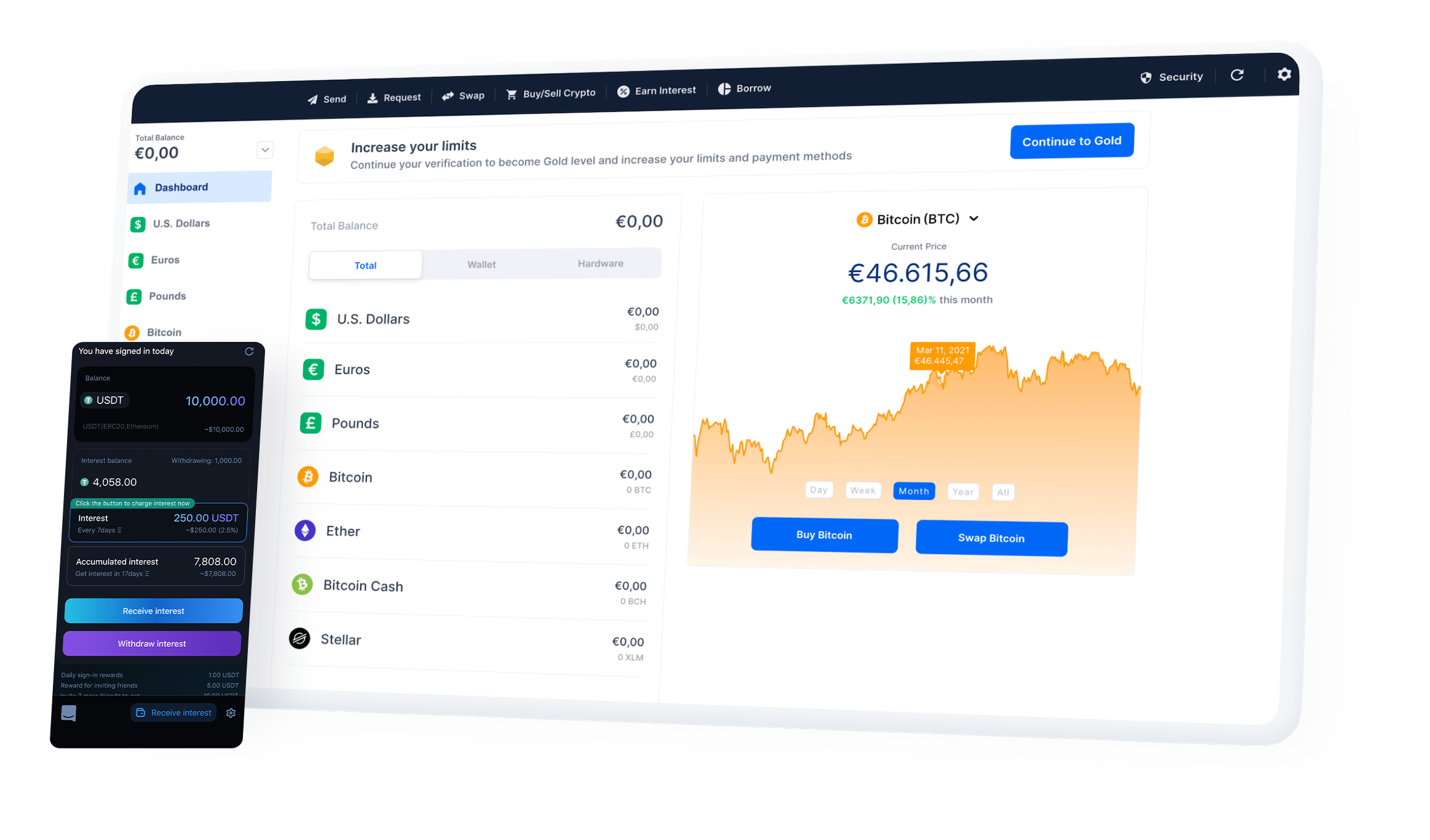

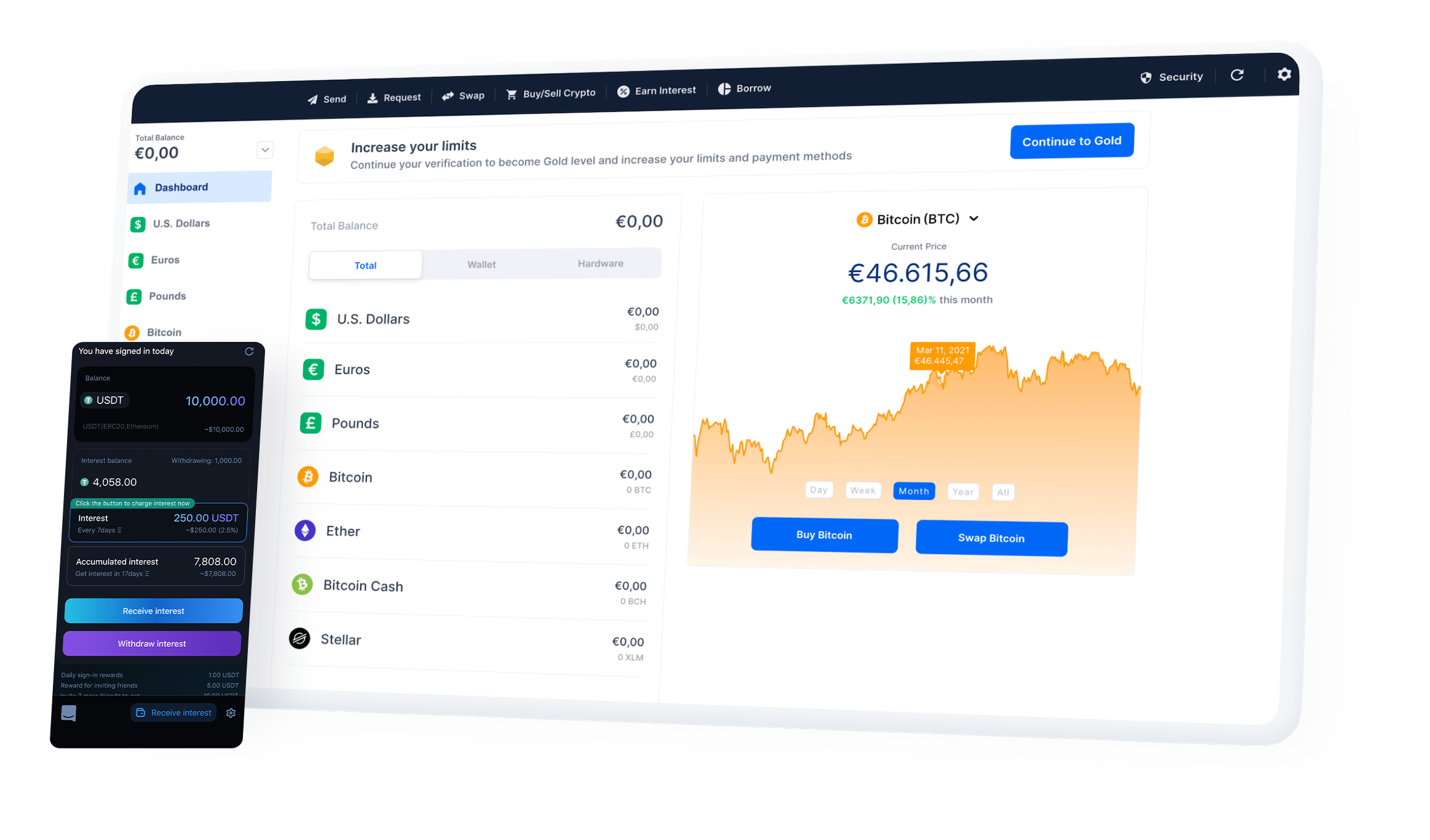

Easy to use high-yield stablecoin Yu'e Bao

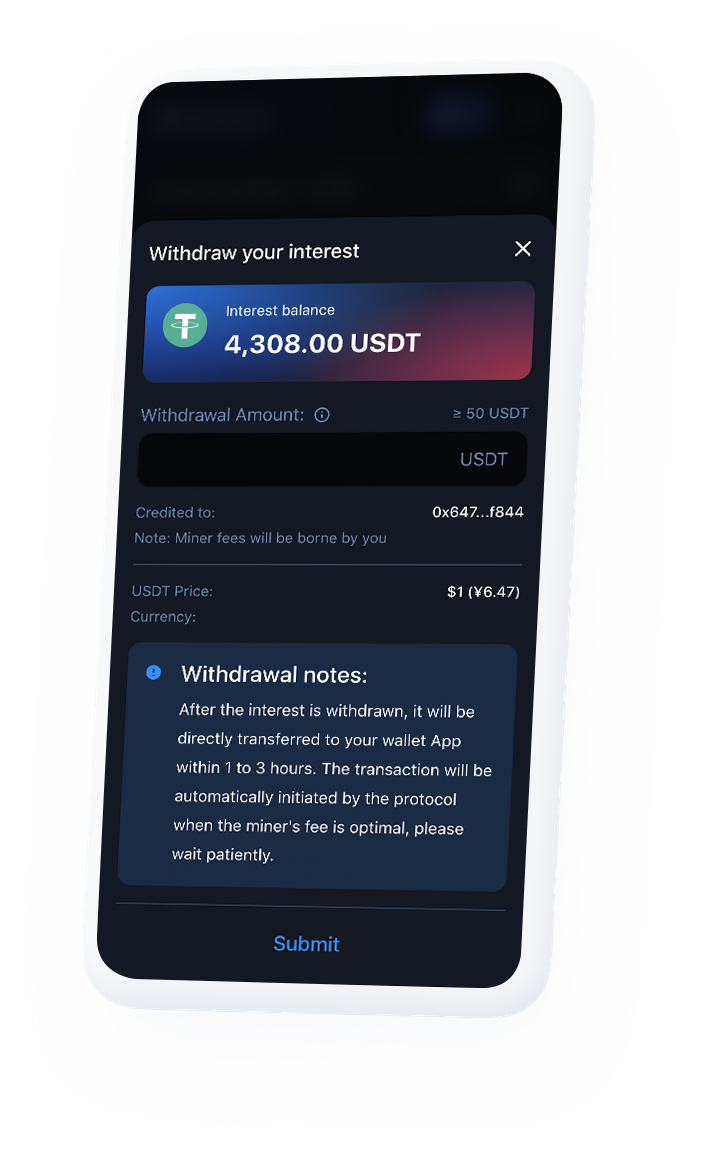

When the USDT balance of the wallet reaches 100USDT, you can regularly obtain interest income, and the interest can be transferred out and credited in real time at any time

TRC20

BEP20

50-499

USDT

every 1 days

+2.1%

TRC20

BEP20

500-4999

USDT

every 1 days

+2.6%

TRC20

BEP20

>5000

USDT

every 1 days

+3%

What is DEFI?

Decentralized finance (DeFi) has always been at the forefront of technological innovation in the blockchain field. What is the uniqueness of DeFi applications? Such applications do not need to set the use rights, and anyone (or any product, such as smart contracts) Just connect to the Internet and have a supported wallet to interact with. In addition, DeFi applications typically do not need to trust any hosting parties or intermediaries. In other words, they are de trusted applications.

What is mobile mining?

And these users are responsible for injecting funds into the liquidity pool. What is a liquidity pool? It basically belongs to a smart contract that holds funds. Liquidity providers (LPs) will inject liquidity into the capital pool and receive rewards in return. This kind of reward comes from the expenses generated by the basic DeFi platform or other sources. The liquidity supplier is responsible for injecting funds into the liquidity fund pool. The fund pool provides financial support for the market platform, where users can lend, borrow or exchange tokens. The use of these platforms will generate royalties, and liquidity providers can be remunerated according to their share. This is the operational basis of automated market makers (AMM). These reward tokens can continue to be deposited into the liquidity fund pool, so as to continue to receive rewards, in turn. I believe you have learned that even extremely complex strategies may soon emerge. Its basic idea is that the liquidity supplier will inject funds into the liquidity fund pool and get returns from it.

How to calculate the income from liquidity mining?

The interest rate of our DeFi product is 2.1% every 24 hours, that is, 2.1% every 24 hours of a natural day. The daily income of the customer's account is 10000X3%=300USDT

Is there any risk in liquidity mining?

The only risk is the devaluation of virtual currency, but we use USDT (U for short) , USDT is a virtual currency that links cryptocurrency with legal tender USD. TEDA currency is a virtual currency that is kept in the foreign exchange reserve account and supported by legal tender. This method can effectively prevent the price of cryptocurrency from fluctuating significantly. Basically, a TEDA is worth one dollar. So as long as the dollar is not inflationary, DeFi has no risk.

Platform and agreement for mobile mining

How can customers obtain profits through liquidity mining? Just enter our website in any wallet that supports TRX and bind it.

"Now, we have learned about the latest upsurge in the field of digital currency - liquidity mining.

How interest-bearing contracts work

The protocol obtains liquidity and currency holding data from various partnered third-party wallet apps, and is able to dynamically adjust transaction volumes (split or integrate) across multiple DeFi contracts to ensure optimal miner fees consume.

At the same time, the protocol provides aggregated information services on exchange protocols and networks, and is deployed on Ethereum and TRON. Through the application of open financial and currency protocols developed based on blockchain technology, an integrated and interoperable The protocol matrix provides a unified liquidity pool infrastructure to serve the open financial network.

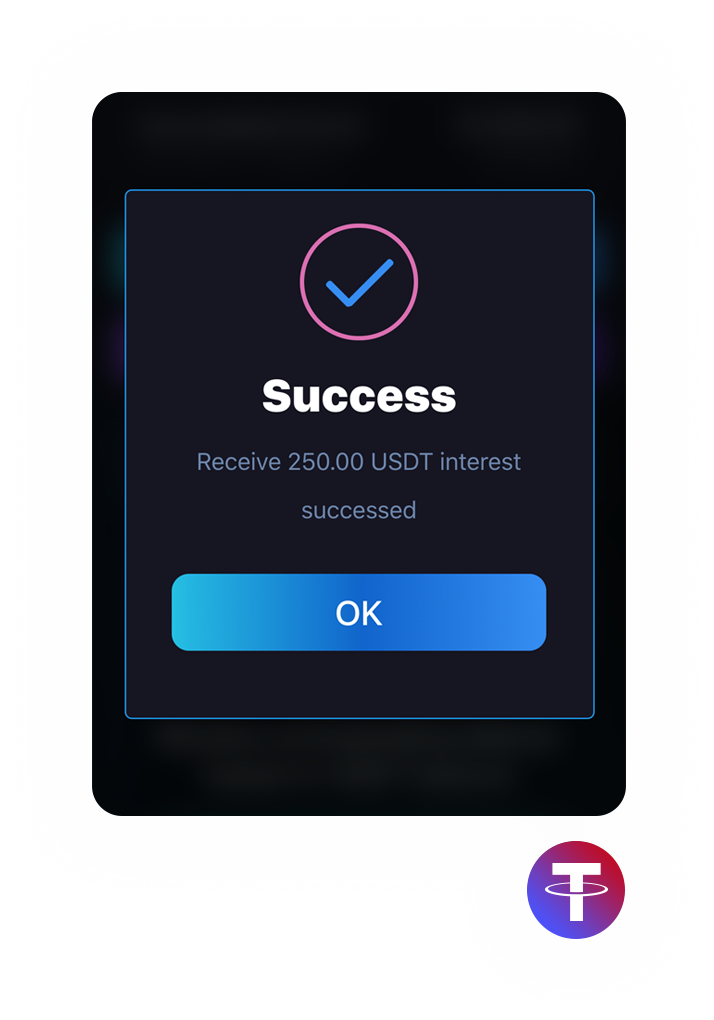

The resulting income will be rewarded to all participating users of the contract as interest.

The main advantage of the interest-bearing network (interest-bearing contract)?

One key to start

Provide users with an integrated solution to automatically participate in DeFi protocols to obtain interest income that takes into account both high yield and high liquidity. Even novice users can easily get started.

The main advantage of the interest-bearing network (interest-bearing contract)?

One key to start

Provide users with an integrated solution to automatically participate in DeFi protocols to obtain interest income that takes into account both high yield and high liquidity. Even novice users can easily get started.

No deposit required

Users only need to deposit assets into the third-party cooperative wallet App, and they can periodically get interest without depositing to our protocol.

High liquidity

Interest deposits and withdrawals are flexible and convenient.

low cost

Since our protocol dynamically adjusts transactions according to the fluctuation of miner fees, it effectively reduces the cost of switching between different protocols and token pools.

Optimal Return

By accessing different DeFi market data and dynamically adjusting the real-time trading volume with DeFi tokens, we can obtain the optimal risk-adjusted interest return.

One key to start

Provide users with an integrated solution to automatically participate in DeFi protocols to obtain interest income that takes into account both high yield and high liquidity. Even novice users can easily get started.

No deposit required

Users only need to deposit assets into the third-party cooperative wallet App, and they can periodically get interest without depositing to our protocol.

High liquidity

Interest deposits and withdrawals are flexible and convenient.

low cost

Since our protocol dynamically adjusts transactions according to the fluctuation of miner fees, it effectively reduces the cost of switching between different protocols and token pools.

Optimal Return

By accessing different DeFi market data and dynamically adjusting the real-time trading volume with DeFi tokens, we can obtain the optimal risk-adjusted interest return.

The interest source of the interest-bearing network?

Yield Network is a core asset protocol based on Ethereum and TRON. It aims to become a high-yield stablecoin Yu'e Bao, providing users with stablecoin interest income with the highest return in the market. Currently supported currencies Including USDT (ERC20) based on Ethereum, USDT (BEP20) based on Binance and USDT (TRC20) based on TRON. Users only need to deposit tokens into the cooperative wallet App, and they can periodically obtain interest income.

As an interest aggregator, the interest-generating network has opened up a lending/liquidity protocol at the bottom layer. Through predictable currency holding data, we can dynamically adjust the transaction volume according to the rise and fall of miners' fees, which can provide users with access to market The highest deposit interest. Users do not need to put their currency into the interest-earning network, but only need to deposit it into a cooperative third-party wallet to obtain the best return. We will continue to evaluate and integrate more open financial protocols, including Hybrid lending platform.

Start nowHow is the security of the living network?

The interest-bearing network is a smart contract deployed on Ethereum, Binance and TRON, and the security audit is done by Trail of Bits.

Friendly reminder: The interest-generating network will not require users to deposit assets, nor will they require users to transfer funds to any address. Only the user can manage the assets stored in the third-party cooperative wallet App through the key, and anyone else Neither can control or alter the transaction.

Please be wary of fake official websites and fake apps

Recently, criminals have induced users to download fake wallet APPs on fake websites to commit fraud. Please look for the official app store AppStore or GooglePlay to download the following wallet APPs

Please be wary of fake official websites and fake apps

Recently, criminals have induced users to download fake wallet APPs on fake websites to commit fraud. Please look for the official app store AppStore or GooglePlay to download the following wallet APPs

ViệtName

ViệtName